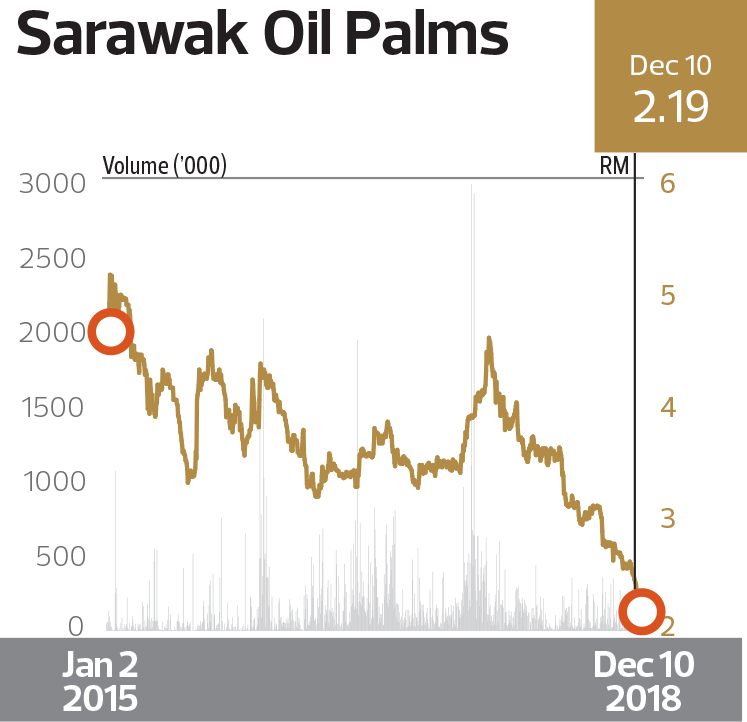

Plantation (Below RM3 billion market capitalisation): Sarawak Oil Palms Berhad – Better yields, better growth

After a dip in earnings in the financial year ended Dec 31, 2015 (FY2015), Sarawak Oil Palms Bhd’s (SOP) profit after tax (PAT) has not just rebounded but hit a multi-year high in FY2017.

After a dip in earnings in the financial year ended Dec 31, 2015 (FY2015), Sarawak Oil Palms Bhd’s (SOP) profit after tax (PAT) has not just rebounded but hit a multi-year high in FY2017.

Thanks to the double-digit growth in fresh fruit bunches (FFB), the plantation group’s PAT grew to RM239.3 million in FY2017 — more than double the RM115.4 million in FY2014 — translating into a three-year compound annual growth rate (CAGR) of 27.5%.

The impressive growth won SOP The Edge BRC award for the highest growth in PAT in the plantation sector.

The group’s revenue leapt to RM4.91 billion in FY2017 from RM4.41 billion in FY2016, RM3.67 billion in FY2015 and RM2.87 billion in FY2014. It is worth noting that SOP’s revenue was only RM683.5 million in FY2008.

Over the past three financial years, SOP had consistently declared a dividend per share of five sen.

The group has relatively young oil palm plantations. It has total planted areas of 88,094ha with trees averaging 10.2 years old.

The group’s FFB production increased from 1.01 million tonnes in FY2016 to 1.37 million tonnes in FY2017, representing an increase of 36% from the previous year. Overall yield (inclusive of FFB production from newly acquired estates) in FY2017 was 17.07 tonnes per hectare compared with 16.79 tonnes per hectare in FY2016. Its oil extraction rate was 20.65%, versus 19.97% in FY2016.

As at FY2017, 31.78% of the group’s plantation was covered by prime age (11 to 12 years old) oil palm, while 54.41% of the trees were young (4 to 10 years old).

The group’s old oil palm trees — those above 21 years old — constituted about 4.59% of its total plantation, while 9.22% remains immature or below four years old. It had replanted a total of 1,834ha.

SOP expanded its oil palm plantations in 2016 through the acquisition of Shin Yang Oil Palm (Sarawak) Sdn Bhd from its parent Shin Yang Holding Sdn Bhd for RM873 million cash. The main assets taken over included a 60 TPH palm oil mill and land bank of 47,000ha, of which 23,798ha have been planted with oil palms. The group’s planted area expanded to 87,744ha in 2016 from 63,517ha previously.

To finance the acquisition, the group made a cash call through a two-for-seven renounceable rights issue of 126.6 million shares at RM2.80 per share.

SOP was originally a joint venture (JV) between Commonwealth Development Corporation (CDC) and the Sarawak government that was set up in 1968 to pioneer the commercial planting of oil palms in Sarawak. The JV had an initial 4,600ha of oil palm plantations under the name of Sarawak Oil Palms Sdn Bhd before the group changed its name officially in 1990.

SOP was listed on Bursa Malaysia in August 1991. In June 1995, Shin Yang Plantations Sdn Bhd bought over CDC’s entire share (25%) in SOP. Presently, Shin Yang Group together with Pelita Holdings Sdn Bhd, an investment arm of the Sarawak government, are the two largest shareholders of SOP with shareholdings of 37.5% and 28.5% respectively.

Pelita has presence in property development, urban development and plantations.

Moving forward, SOP says its performance in FY2018 would continue to be driven by FFB production and palm products’ price movements, which is dependent on the world edible oil market, movement of the ringgit and the economic conditions. Improved cost control by plantation companies will definitely help ease pressure on profit margins in FY2018 given the recent weakness in the price of crude palm oil.

Source: The Edge Malaysia – http://www.theedgemarkets.com/article/highest-growth-profit-after-tax-over-three-years-plantation-below-rm3-billion-market